Spectacular Food Industry Financial Ratios

Current and historical current ratio for Restaurant Brands QSR from 2013 to 2021.

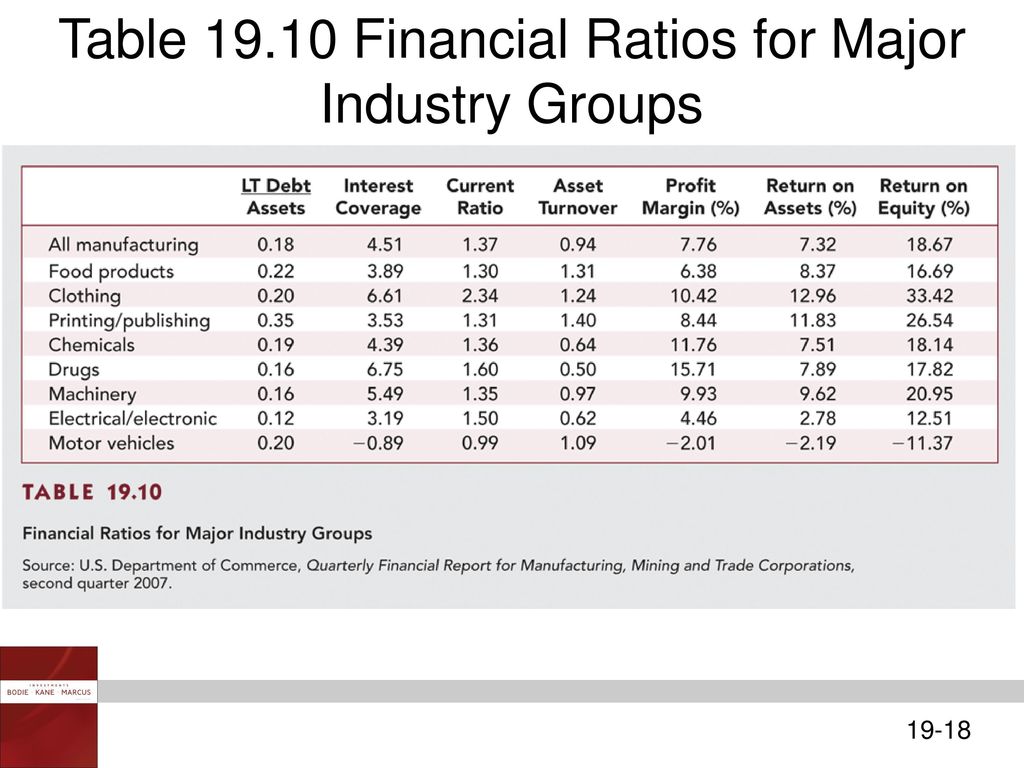

Food industry financial ratios. Say you have 100000 in Total Assets and 1000000 in Net Sales your Assets to Sales would be 100000 1000000 or 1. It provides financial statement benchmarking data of 250 industries. Data - Benchmarking of.

20 - Food And Kindred Products Measure of center. Multi-year financial averages for all companies in the industry 3. For example an Assets to Sales Ratio Total Assets Net Sales.

Some of the key metrics most commonly used to evaluate companies in the food and beverage sector are profitability measures such as operating. In other words Financial Ratios compare relationships among entries from a companys financial information. Quick Ratio total ranking has deteriorated compare to the previous quarter from to 17.

Current ratio can be defined as a liquidity ratio that measures a companys ability to pay short-term obligations. IRS financial ratios is the only source of financial ratio benchmarks created from more than 5 million corporate tax returns collected by the IRS. This industrys financial ratios compared to all other industries.

Ten years of annual and quarterly financial ratios and margins for analysis of Restaurant Brands QSR. Average industry financial ratios for US. On the trailing twelve months basis Due to increase in Current Liabilities in the 2 Q 2021 Quick Ratio fell to 023 below Food Processing Industry average.

Financial efficiency is measured by five ratios. 103 rows Revenue per Employee in the 2. Food costs 32 or less of food sales Fine dining establishments will be more than 32 and could be as high as 40 Liquor costs 20 or less of liquor sales Bottled beer.

/GettyImages-1035408114-660f2907ceff45728346925a4b8c18a9.jpg)