Simple Financial Liabilities At Fair Value Through Profit And Loss

These include financial liabilities that the entity either holds for trading purposes or upon initial recognition it designates as at fair value through profit or loss.

Financial liabilities at fair value through profit and loss. These types of assets have a value that is constantly in flux as a result of changes in the market. The debt will then be revalued to fair value each year and any changes taken through profit or loss. The amount of change in fair value attributable to changes in credit risk of the liability presented in OCI and the remaining amount presented in PL.

An entity also has the right to designate any asset other than a. Derecognition of Financial Liabilities. So the calculations are the same.

There are two categories of financial liabilities. The available-for-sale category includes all equity securities other than those classified as at fair value through profit or loss. At fair value through profit or loss.

IFRS 9 classifies financial liabilities into 2 categories. Financial liabilities at fair value through profit or loss. IFRS 9 describes requirements for subsequent measurement and accounting treatment for each.

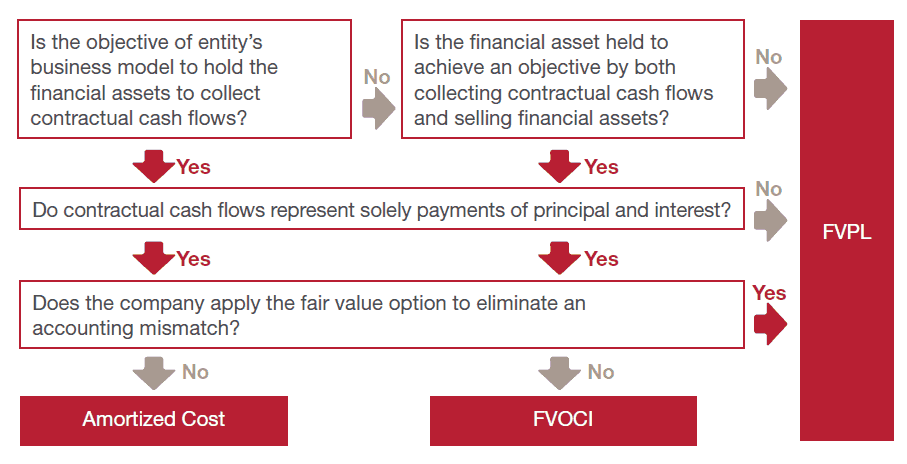

The new standard is based on the concept that financial assets should be classified and measured at fair value with changes in fair value recognized in profit and loss as they arise FVPL unless restrictive criteria are met for classifying and measuring the asset at either Amortized Cost or Fair Value Through Other Comprehensive Income FVOCI. Under IFRS 9 all financial instruments are initially measured at fair value plus or minus in the case of a financial asset or financial liability not at fair value through profit or loss transaction costs. It is held for trading or It is designated by the entity as being at FVTPL note that such a designation is only permitted if specified conditions are met.

The category of financial liability at fair value through profit or loss has two subcategories. It is designated by the entity as at fair value through profit or loss note that such a designation is only permitted if specified conditions are met. All financial assets that are not classified in another category are classified as available for sale.