Peerless Audit Of Petty Cash Fund

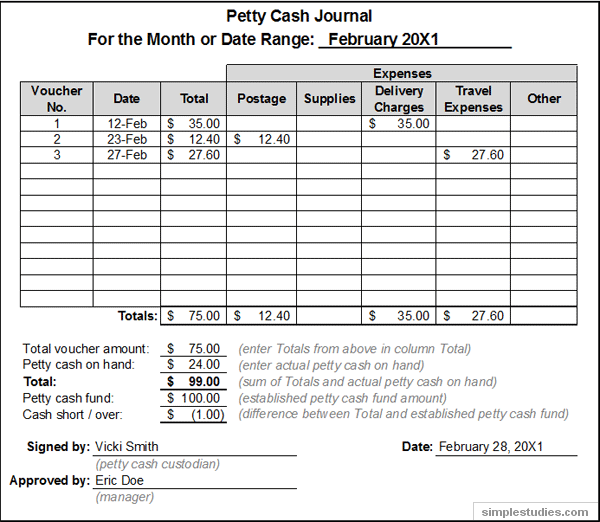

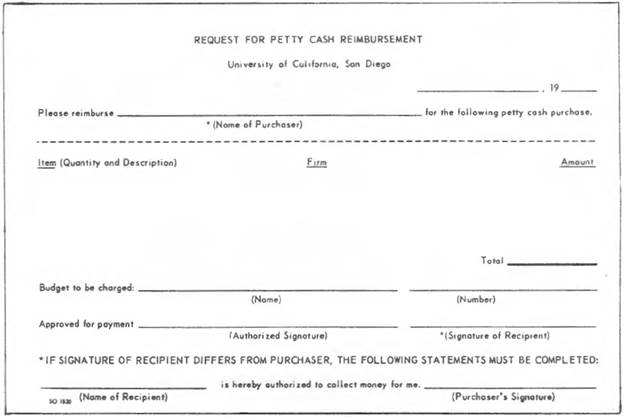

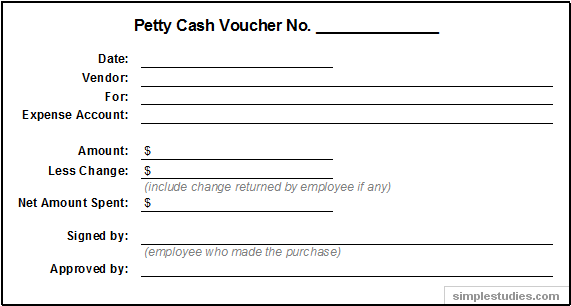

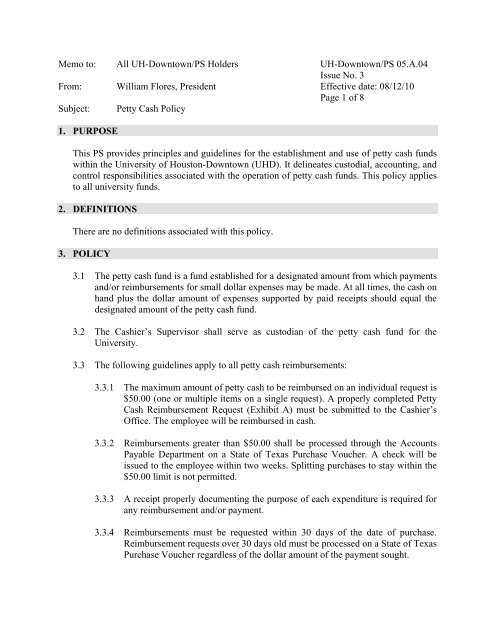

When using the reimbursement method an individual purchases an authorized item with personal funds provides the original detailed vendor receipt to the petty cash funds custodian and is then reimbursed from the petty cash fund.

Audit of petty cash fund. 01 1080000 Security Bank current account No. Petty cash floats are set up to enable employees to pay for minor items of expenditure without having to complete an official order. All payments must be made by check.

02 80000 PNB savings account 1200000 PNB time deposit 500000 Cash on hand includes the following items. The reimbursement method and the advance method. Although an organizations petty cash fund is inherently prone to fraud and abuse it often receives minor attention during an internal audit due to its low materiality.

A petty cash fund is a small amount of cash held by an organization or its separate departments for small day-to-day expenditures. Custodians should close inactive petty cash funds. Local unit management should perform unannounced petty cash audits.

The review was conducted at the request of. Total Accountability P 341628. Local petty cash custodians are responsible for safeguarding petty cash funds and maintaining receipts and detail records to support all transactions.

Home Internal Audit Checklists Petty Cash Management Audit Checklist. Only payments in small amounts may be made through the petty cash fund. The purpose of this review was to provide senior management with an assurance about the adequacy and effectiveness of internal control.

Petty cash funds should be maintained in a secure area such as a locked drawer or small safe. The following entry records this transaction as follows. The 78 petty cash funds.