Brilliant Audit Fees In Balance Sheet

The audit approach is the strategy or methodology that auditors use to perform an audit of financial statements.

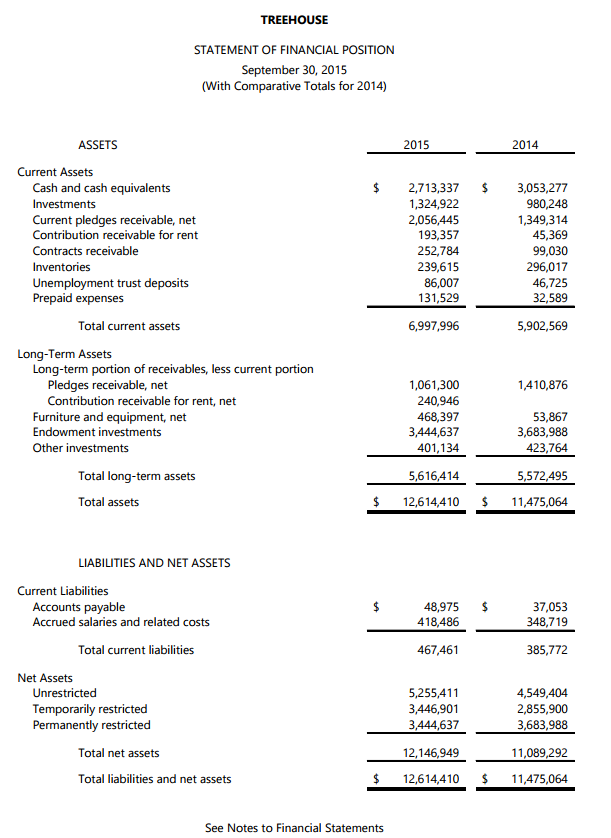

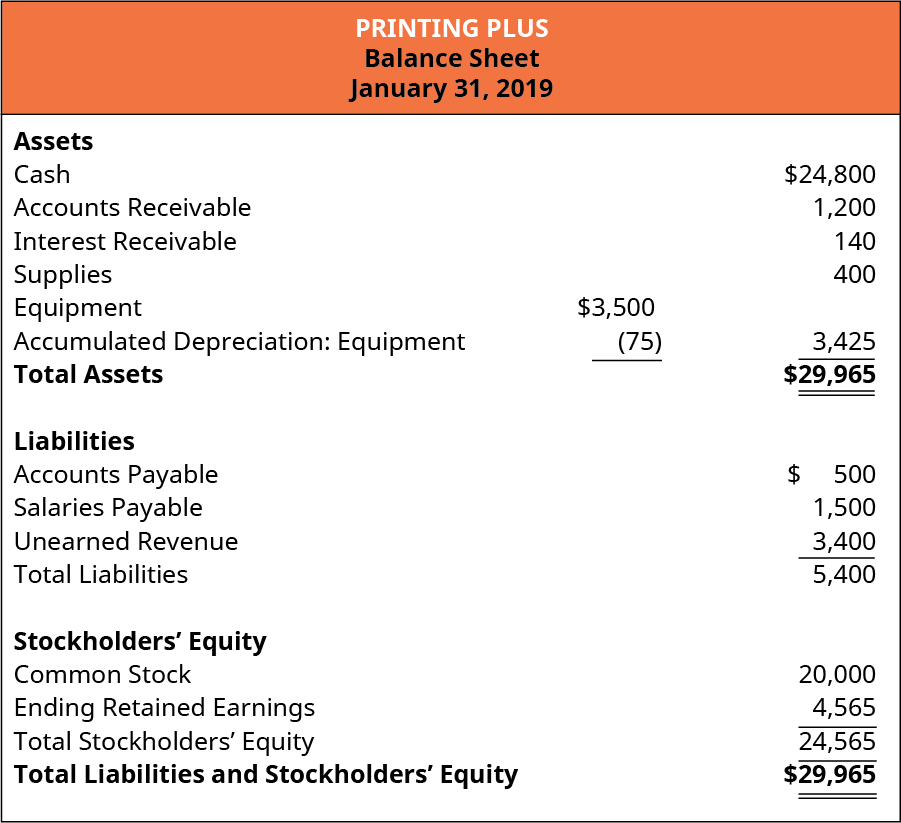

Audit fees in balance sheet. An audit of a balance sheet also includes assessing the accounting principles used and significant estimates made by management as well as evaluating the overall balance sheet presentation. Bonds Subscriptions Outstanding Furniture 2050 1600 31000 1000 3250. To ensure that all assets owned by the organization are included in the balance sheet at the correct value.

Rent Rates and Taxes. Account Balance Assertions. This means that the entity owns the ownership rights for all the assets recognized in the balance sheet and all the recognized liabilities are the obligations of the entity.

Auditor of a sole trader is appointed by the sole proprietor. Annual maintenance Contract etc. Do comparison on expense ratios.

The company has the right to control and use its assets and have obligations to pay its liabilities. An auditor is liable to be guilty of misfeasance for signing the balance sheet blindly and has to suffer the consequences if such balance sheet is found subsequently to be incorrect. This result holds for all intangible assets goodwill type intangible assets and intangible assets other than goodwill.

3-5 years of data spreadsheet format 12 months of data from test year Take from annual reports trial balances other available documents May include. To ensure that the assets shown in the balance sheet are in fact owned by the organization. Tax audit is provide by section 44 AB.

14 Prepare Depreciation Chart as per Companies Act and Income Tax Act and pass entry for the same. To ensure that accepted accounting principles are followed to prepare the balance sheet. 13 For returns not filed make provision for interestpenalty for the same.

:max_bytes(150000):strip_icc()/dotdash_Final_Liability_Definition_Aug_2020-01-5c53eb9b2a12410c92009f6525b70e7a.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)